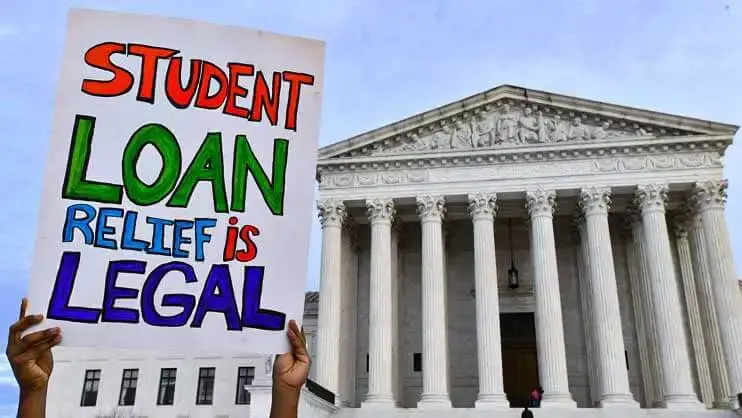

Supreme Court allows student loan debt settlement The Supreme Court’s decision to allow a $6 billion student loan debt settlement marks a significant victory for borrowers who have struggled to pay off their loans. The settlement was reached between the federal government and a group of borrowers who accused the government of mismanaging a loan forgiveness program.

The case, which the Supreme Court heard in March 2023, centered on the Public Service Loan Forgiveness (PSLF) program. The program was created in 2007 to encourage graduates to pursue public service careers by forgiving their student loans after ten years of service. However, issues have plagued the program, and many borrowers who thought they were eligible for forgiveness have been denied.

Supreme Court allows student loan debt settlement Relieve

The settlement will relieve an estimated 200,000 borrowers who were denied loan forgiveness under the PSLF program. The settlement includes $2 billion in loan forgiveness and $4 billion in compensation for borrowers the government misled about their eligibility for the program.

The decision by the Supreme Court allows student loan debt settlement to be a significant victory for borrowers, but it also has broader implications for the student loan industry as a whole. Here’s what you need to know about the settlement and what it means for borrowers.

What is the Public Service Loan Forgiveness program?

The Public Service Loan Forgiveness (PSLF) program was created in 2007 to encourage graduates to pursue public service careers by forgiving their student loans after ten years of service. To be eligible for the program, borrowers must make 120 qualifying payments while working for a qualifying employer.

Qualifying employers include government organizations, non-profit organizations, and others that provide public services. Qualifying payments must be made while the borrower is employed full-time by a qualifying employer.

What were the issues with the PSLF program?

Issues have plagued the PSLF program since its inception. Many borrowers who thought they were eligible for forgiveness were denied, and the program has been criticized for its complex requirements and lack of transparency.

According to the lawsuit against the government, the Department of Education “failed to properly administer the PSLF program, resulting in widespread errors, delays, and miscommunications that have harmed and continue to harm public service workers.”

Borrowers who were denied forgiveness under the program cited various reasons, including incorrect information provided by loan servicers and delays in processing applications.

What does the settlement mean for borrowers?

The $6 billion settlement will relieve an estimated 200,000 borrowers who were denied loan forgiveness under the PSLF program. The settlement includes $2 billion in loan forgiveness and $4 billion in compensation for borrowers the government misled about their eligibility for the program.

Borrowers eligible for loan forgiveness under the settlement will have their loans discharged tax-free. The settlement also includes provisions to ensure that borrowers receive accurate information about their eligibility for loan forgiveness in the future.

The settlement Supreme Court allows for student loan debt settlement is a significant victory for borrowers who have struggled to pay off their student loans. Still, it is also a reminder of the broader issues facing the student loan industry. With student loan debt reaching record levels in the United States, many borrowers are struggling to make ends meet, and the PSLF program is just one example of the challenges they face.

Conclusion

The Supreme Court allows student loan debt settlement Supreme Court’s decision to allow a $6 billion student loan debt settlement is a significant victory for borrowers who have struggled to pay off their loans. The settlement will relieve an estimated 200,000 borrowers who were denied loan forgiveness under the Public Service Loan Forgiveness (PSLF) program.

Issues have plagued the PSLF program since its inception, and the settlement is a reminder of the broader issues facing the student loan industry. With student loan debt reaching record levels in the United States, many borrowers need help to make ends meet.

Supreme Court allows student loan debt settlement Detail

| Loan | Debt settlement |

| Type | 4 |

| Payment | $6 billion |

| Program | PSLF |

| Borrowers | 200,000 |

| Created Loan | 2007 |

What were the issues with the PSLF program?

Issues have plagued the PSLF program since its inception.

What does the settlement mean for borrowers?

The $6 billion settlement will relieve an estimated 200,000 borrowers who were denied loan forgiveness under the PSLF program.

What is the Public Service Loan Forgiveness program?

The Public Service Loan Forgiveness (PSLF) program was created in 2007 to encourage graduates to pursue public service careers by forgiving their student loans after ten years of service.